When navigating the complex world of home buying, one crucial document you'll encounter is the Loan Estimate (LE). Understanding what this estimate entails and why it matters is essential for any prospective homebuyer.

What is a Loan Estimate?

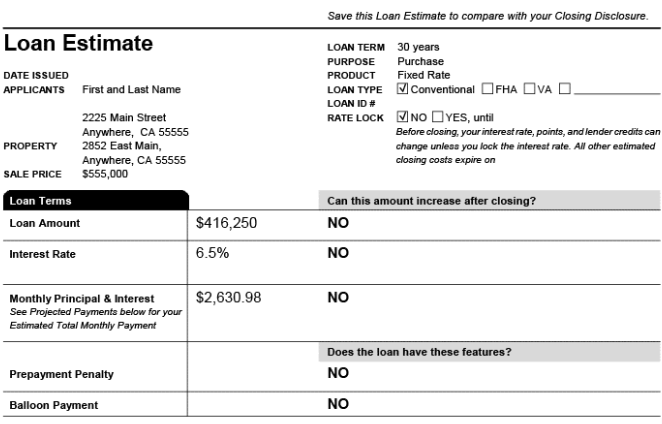

The Loan Estimate is a standardized form provided by lenders that outlines the estimated costs associated with obtaining a mortgage. This document is typically given to borrowers shortly after they apply for a loan and is designed to help you understand the financial implications of your mortgage.

Key Components of the LE

- Loan Amount: This reflects the total amount you plan to borrow.

- Interest Rate: The LE outlines the estimated interest rate, helping you gauge your monthly payments.

- Monthly Payment: You'll see an estimate of what your monthly mortgage payment will look like, including principal, interest, taxes, and insurance.

- Closing Costs: The LE breaks down various fees associated with closing the loan, such as appraisal fees, title insurance, and origination fees.

- Total Cost of the Loan: It provides an overview of the total cost over the life of the loan, allowing you to see the big picture.

Why is the Loan Estimate Important?

- Transparency: The LE promotes transparency in the lending process by clearly outlining potential costs, which can help you compare offers from different lenders.

- Budgeting: Knowing your estimated costs upfront allows you to plan your finances more effectively, ensuring that you can manage your budget throughout the home buying process.

- Protection Against Surprises: The LE helps protect buyers from unexpected fees and charges at closing, as lenders are required to adhere closely to the estimates provided.

- Informed Decisions: With a clear understanding of costs, you can make informed decisions about which mortgage options best suit your financial situation and goals.

Conclusion

The Loan Estimate is a vital tool for any homebuyer. It not only helps clarify the financial aspects of your mortgage but also empowers you to make informed choices as you embark on this significant investment.

Have questions about your Loan Estimate? Contact me for clarity! Your journey to homeownership should be as smooth and transparent as possible, and I'm here to help!